· Guide · ![]() Yanko · 2 min read

Yanko · 2 min read

Why a Buffer Fund Is Essential for Your Finances

A powerful tool that helps you plan your finances more effectively

A buffer fund is like a credit amount equal to or greater than one month of your income, but without the risk of high interest rates or slipping into debt. Once your salary arrives, the buffer is automatically refilled.

Why You Need a Buffer Fund?

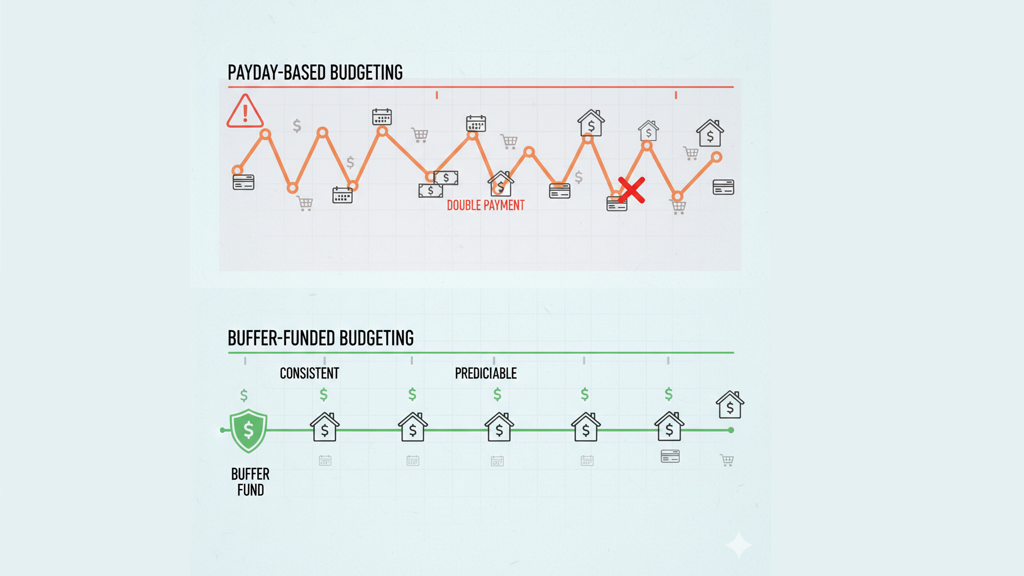

If your budget cycle is tied directly to your payday, it can become unreliable. Because pay dates can shift, one budget cycle might end up longer than the previous one, occasionally forcing you to pay the same recurring bill twice within a single cycle. This inconsistency makes it difficult to compare months or plan effectively for the future.

In Monnetta, a budget cycle is defined as a standard calendar month. By aligning your budget with the calendar rather than your payday, you gain consistency, control, and the ability to compare cycles accurately since they are of equal length and contain similar expenses.

A buffer fund is the key to making this system work. It acts as a bridge, allowing you to fund the start of each month confidently without having to wait for your next paycheck to arrive.

Example

Imagine you get paid $10,000 on the 10th of each month.

Instead of waiting for payday, you can use the $10,000 buffer and start with the cycle. When your salary arrives on the 10th, it refills the buffer.

Benefits of a Buffer Fund

- ✅ Start every month with a clear budget

- ✅ Avoid waiting for your paycheck to plan or spend

- ✅ Reduce stress from income delays or fluctuations

- ✅ Stay out of debt or overdraft

- ✅ Build long-term financial resilience

How Much Should You Keep?

- Minimum: One month of essential expenses

- Ideal: One full month of income

The more you save, the more flexibility and peace of mind you gain.

Final Thought

A buffer fund isn’t just backup money. It’s a tool for predictability and control.

In Monnetta, it helps you stop reacting to income timing and start owning your financial rhythm. Just as we believe:

Plan first. Track second.