· Insights · ![]() Rali · 3 min read

Rali · 3 min read

The Real Reason Couples Are Still Surprised by Their Spending

How waiting until month-end keeps you in a cycle of financial surprises

It’s not because they don’t care.

They’re surprised because awareness comes too late.

At the end of the month, there are numbers, reports, surprises, and disappointment.

For a long time, this was our reality too.

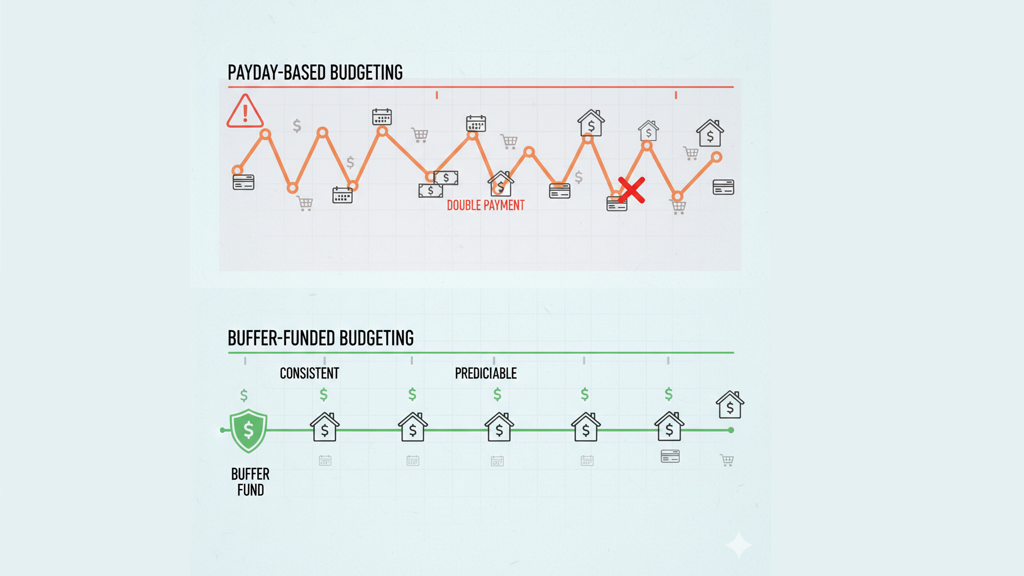

We reviewed our finances once or twice a month, believing that seeing the full picture would finally help us stay in control. Instead, we kept reacting to what had already happened.

We had statistics.

We had reports.

And we were still caught off guard.

The data was accurate, but we had no way to influence everyday decisions as they were happening. The numbers came too late to be useful.

That approach gave us very little value.

So instead of trying to “catch up” with our money, we focused on something much simpler: consistency. We built a habit of logging expenses every day, instead of doing it once or twice a month. That change led to real-time awareness. At any moment, we knew where we stood:

- what we had already spent

- what was left

- and how close we were to our plan

That made everyday decisions calmer. Impulsive spending became intentional. Choices like dining out stopped feeling automatic and started feeling conscious.

This is what consistency creates: awareness while decisions are still easy to adjust.

For couples with shared finances, this matters more than almost anything else. Because money problems rarely come from one big mistake. They come from not knowing what’s happening day-to-day—until it’s too late to course-correct.

Why Manual Tracking Is Key

We live in a fast-paced world where spending is designed to be instant. Bills are paid automatically. Payments happen without taking out a wallet. Money leaves our accounts with almost no friction.

That convenience is powerful and very comfortable. But it also makes spending easy to forget. When money moves invisibly, awareness fades. We spend more easily and often don’t know what’s actually left or what tradeoffs we’re making.

Manual logging changes that.

When we enter a transaction by hand, we process it. We remember it. It becomes real in a way that an automated notification never does. Over time, this builds a shared understanding of where our money is going. That small pause is often enough to notice whether a purchase is a need or a want — and to stay aligned with our goals.

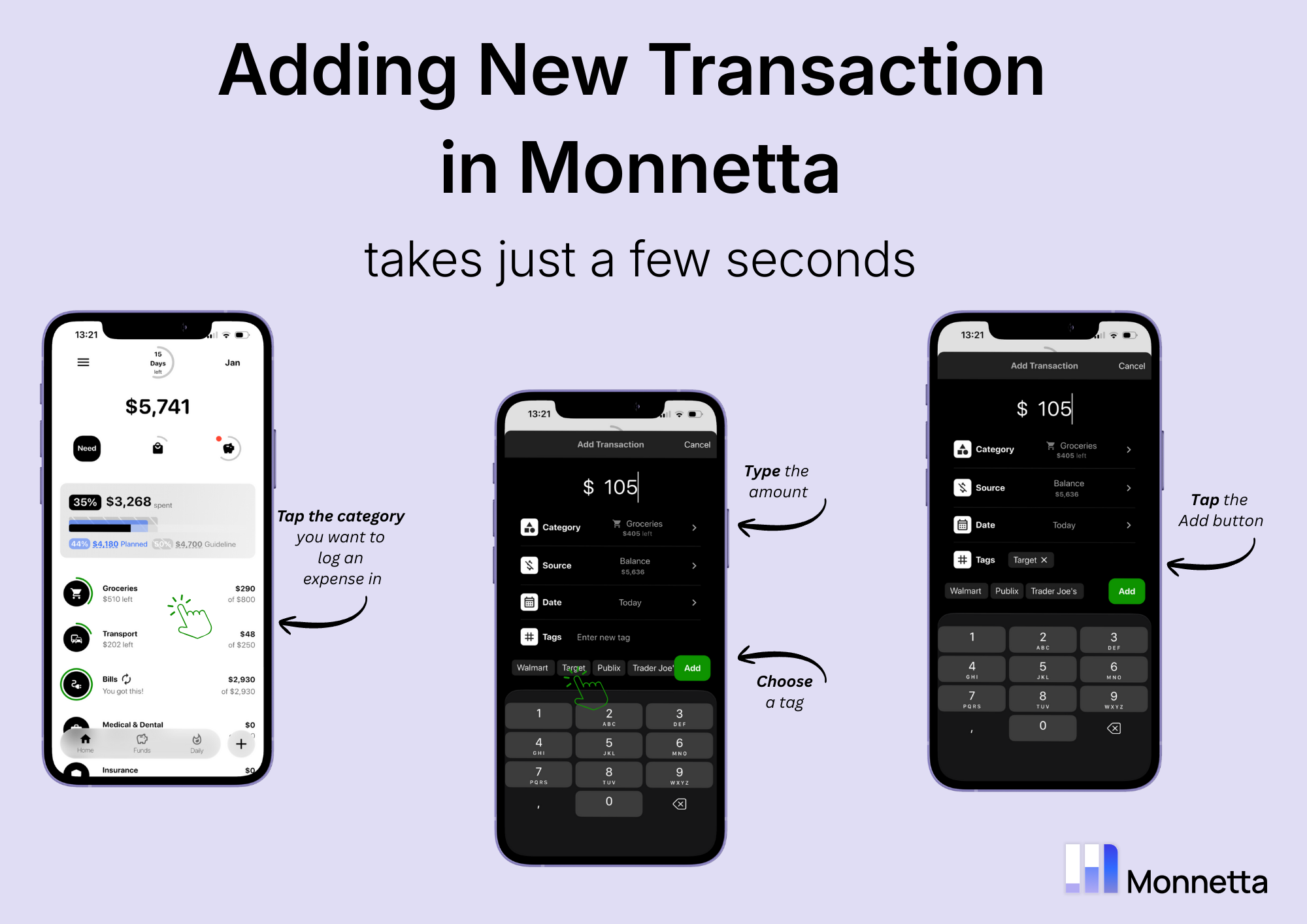

That’s why, when we decided to create Monnetta, one thing was never a question: Transactions had to be logged manually. Not because effort creates discipline — but because awareness creates better decisions. This is also why Monnetta is designed to be offline-first. No automation tools are needed. No waiting for syncs. No delayed clarity.

At the same time, we’ve spent a lot of time making the process as quick as possible. Because consistency only works when the system fits real life.

Here’s what that looks like in practice: